Verifactu is a system promoted by the Spanish Tax Agency (AEAT) to combat tax fraud. Find out when it comes into effect, who it affects, and how it works.

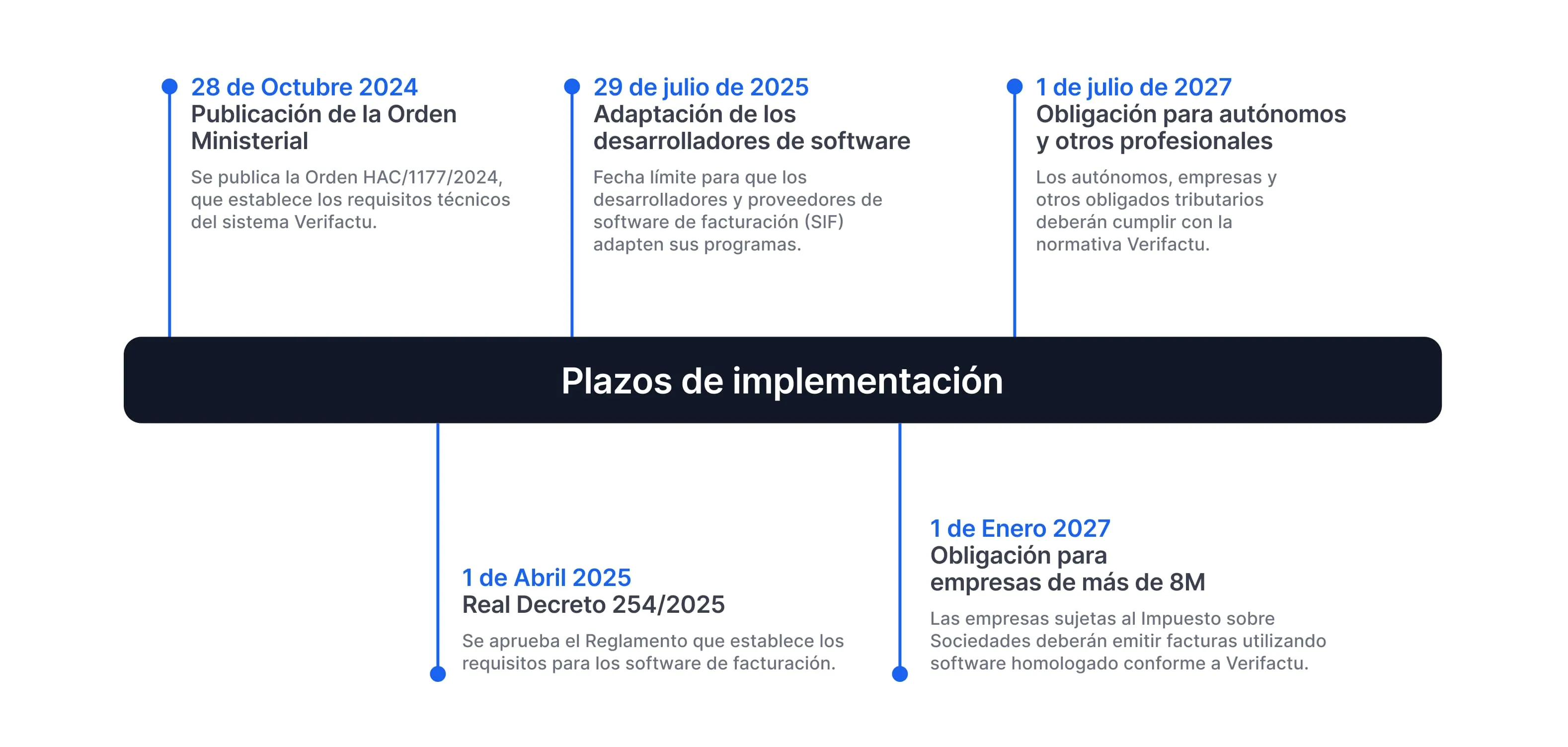

The deadline for software submissions is July 29, 2025.

The deadline for adapting your billing programs is January 1, 2027.

The deadline is set for July 1, 2027.

Professionals and businesses must ensure they choose invoicing software that meets their requirements, such as Holded.

The obligation applies to all those who issue invoices, regardless of the size of the company or the volume of turnover.

The autonomous regions (which have their own systems).

Companies covered by the Immediate Information Supply (SII) system.

Those that are not required to issue invoices.

Ensure the integrity and immutability of records using hashes and electronic signatures. Immediately generate a billing record for each invoice issued to facilitate traceability.

Ensure traceability through a chain of records that allows each invoice to be tracked. Link invoices together to facilitate verification and enable the generation of a cancellation invoice record with content similar to that of the registration record, in the event that an incorrect invoice is issued.

Secure, accurate, automatic, complete, continuous, consecutive, and instantaneous transmission of information to the Spanish Tax Agency (AEAT). Guarantees the generation of accurate and authentic billing records.

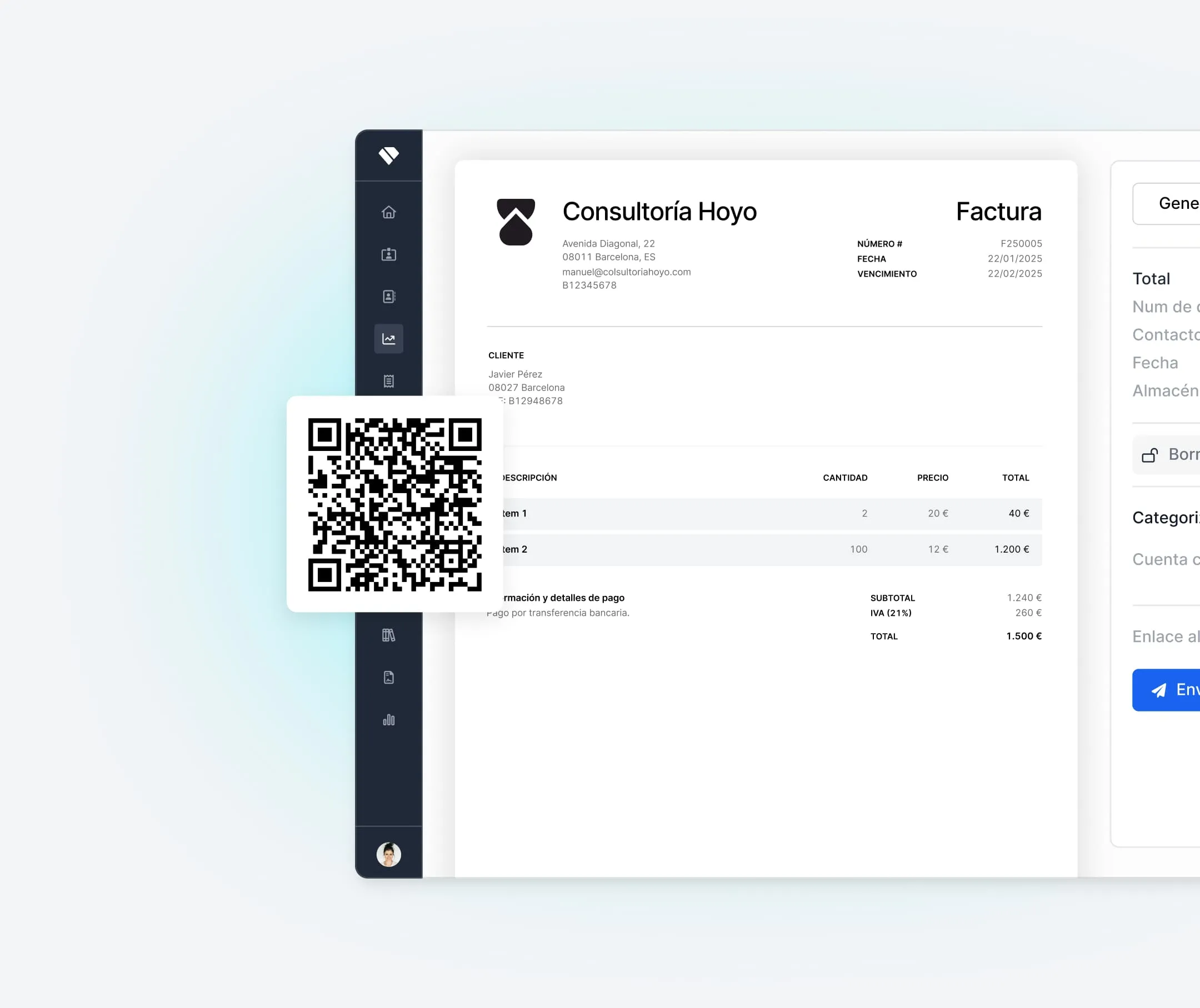

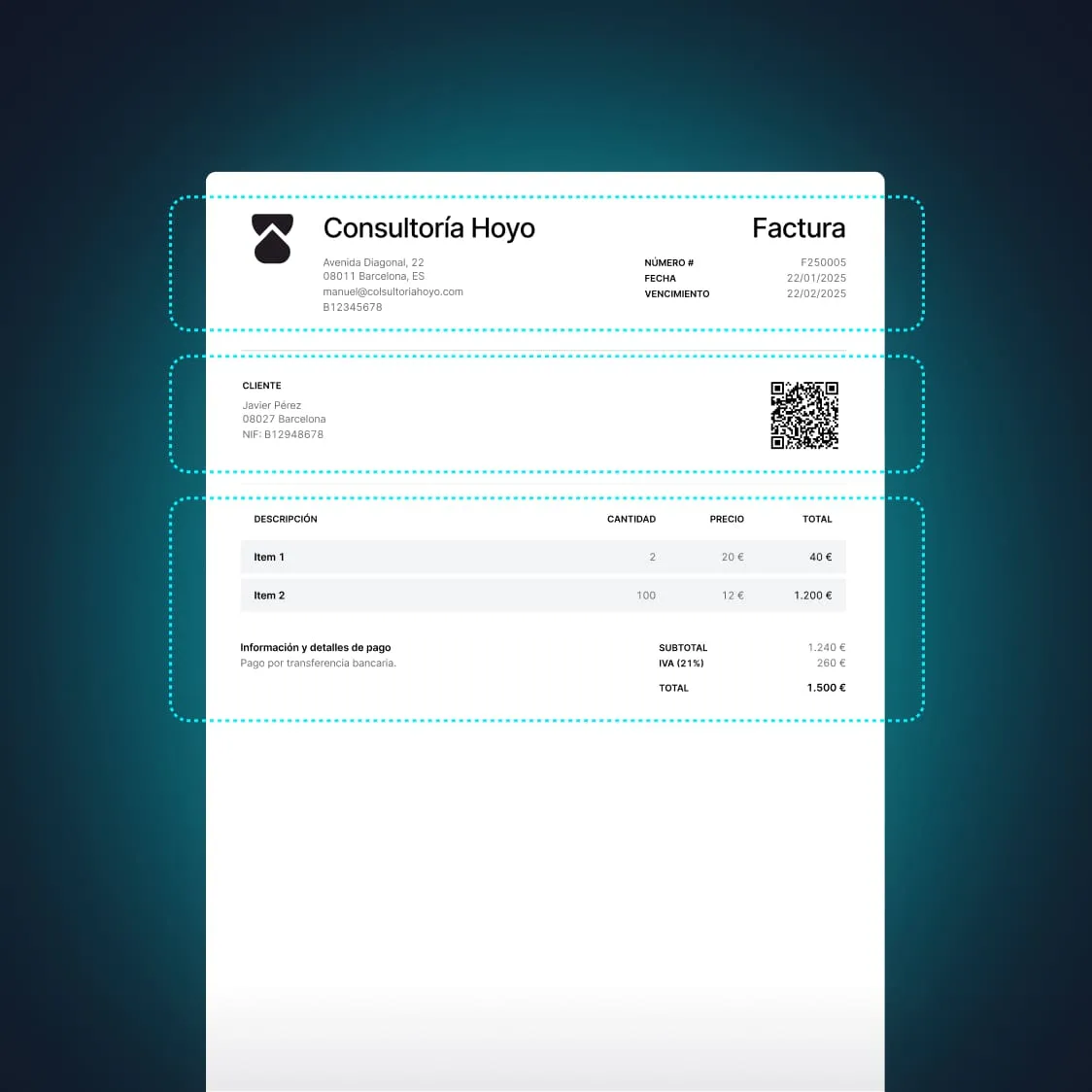

Invoices must include a QR code with relevant information and the legend “VERI*FACTU” to indicate that they have been generated using a verifiable invoice issuance system. It integrates a tool for adding a fingerprint or hash and an electronic signature.

By complying with official regulations, the risk of penalties, inspections, and accounting errors is reduced, and it also helps to reduce tax fraud.

It provides greater security and transparency in commercial transactions and helps increase customer and consumer confidence.

Although voluntary, instant submission can be a competitive advantage by streamlining invoice validation and avoiding problems with tax returns, as it creates a transparent record that facilitates auditing.

It guarantees the authenticity and integrity of electronic invoices, automating and simplifying the verification process.

This way, you can find out if billing software meets Verifactu system requirements.

Ensure the integrity and immutability of records through hashes and electronic signatures.

Data submission. They must be able to manage electronic certificates and generate an electronic signature for each record.

Ensure traceability through a chain of records that allows each invoice to be tracked.

Program providers must provide a responsible statement certifying compliance with the requirements.

Store information in an accessible and exportable format, allowing records to be retrieved electronically.

Invoices must include a QR code with relevant information and the caption “Invoice verifiable at the AEAT electronic headquarters.”

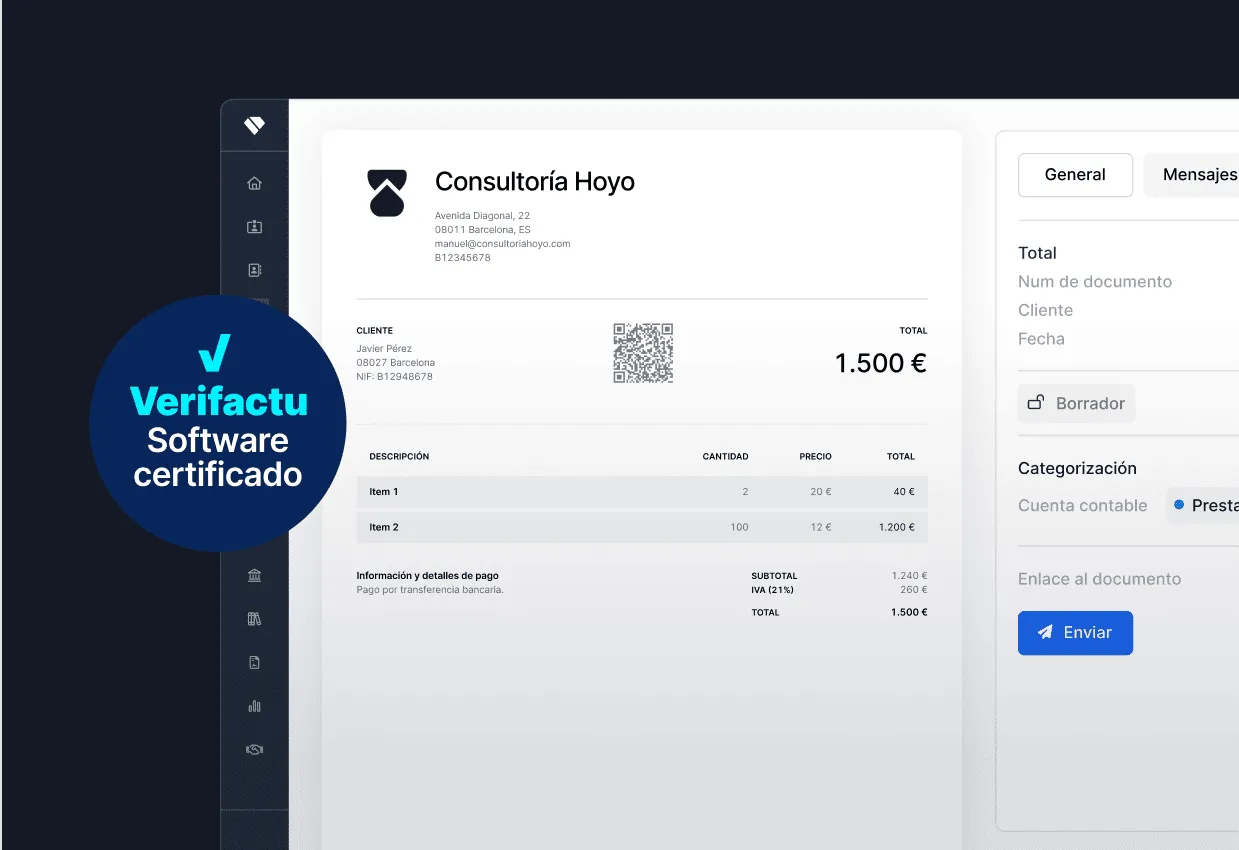

Holded already complies with the Anti-Fraud Law and Verifactu regulations. In this video, you can see how to request pre-activation in the program and how to configure it afterwards.

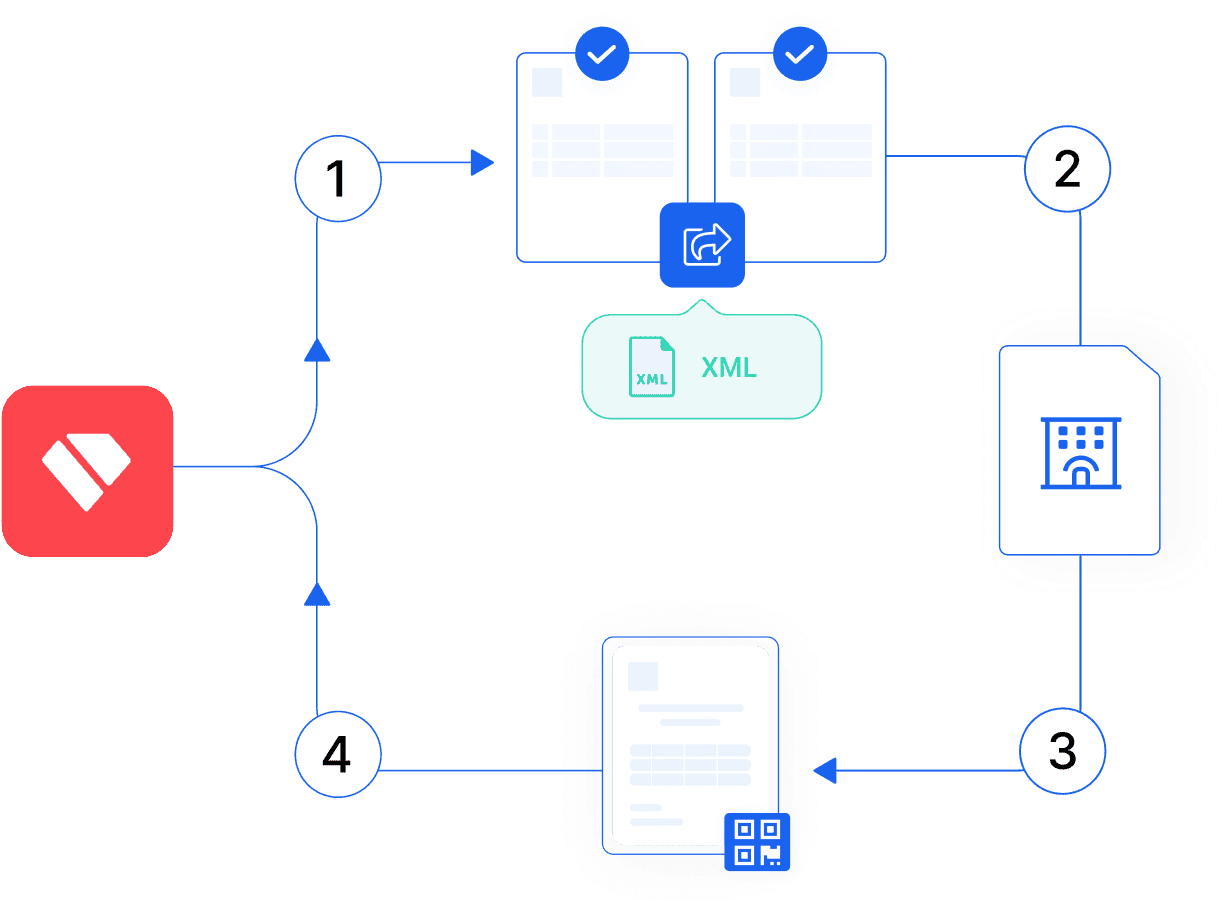

Basic information for understanding how the system works.

First, a computer file is generated, electronically signed and with a hash, for each delivery of goods or services.

Simultaneously with the generation, the file is sent to the Spanish Tax Agency.

On the other hand, the ticket with the QR code and alphanumeric code intended for the buyer is printed.

The buyer may check whether the receipt or invoice is available on the AEAT's website. The Tax Agency is required to provide information about receipt.

The Verifactu Regulation is a set of rules designed to regulate the issuance of electronic invoices, ensuring the authenticity, integrity, and verification of commercial transactions. It seeks to optimize invoicing processes through secure technological systems that are aligned with legal and tax requirements.

The Crea y Crece Law and the Anti-Fraud Law are complementary regulations that seek to modernize and control the invoicing system in Spain.

Crea y Crece Law: It establishes the mandatory use of electronic invoicing in B2B relationships, with the aim of reducing late payments and promoting digitization.

Anti-fraud Law: Introduces technical requirements for invoicing systems, creating the Verifactu system to ensure the integrity and traceability of invoices and prevent tax fraud.

We'll tell you how to do it step by step.

Each time an invoice is issued, the computerized invoicing system (SIF) must generate a high-level invoicing record.

Number, series, date, amount, invoice type, among others. A digital fingerprint that guarantees the unalterability of the record. Identification of the issuing system and the date and time the record was generated.

Mandatory text: “Invoice generated using a VERI*FACTU system.”

Allows the Spanish Tax Agency (AEAT) or the customer to verify the invoice details.

Guarantees integrity and immutability (not displayed, but saved).

The implementation of Verifactu will have a different impact depending on the type of business and tax regime. Below, we detail the implications for each group:

It is foreseeable that the implementation of the Verifactu system will lead to the disappearance of the objective assessment or module taxation model.

It loses its meaning when the Spanish Tax Agency (AEAT) knows in real time the self-employed person's turnover levels under this regime.

Although no final decision has been made yet, it seems likely that the system will shift towards a VAT exemption model.

It is common in other European Union countries and means that certain self-employed workers could switch from declaring VAT quarterly to doing so annually.

All B2B invoices must be electronic and issued using an approved invoicing program.

It requires some investment in digital tools or opting for the Public Solution.

They do not have to be electronic, unless the customer requests it.

Learn all the key features of the Verifactu system in a simple way and find out if your business is ready for the change.

The obligation to comply with Verifactu applies equally to domestic and international transactions, even if the latter are exempt from VAT and, therefore, only need to be declared for income tax purposes.

Therefore, all transactions carried out by Spanish taxpayers must be invoiced in accordance with Verifactu regulations from the moment they are required to do so.

The Tax Agency provides for serious penalties that may be imposed on invoicing programs that do not comply with the requirements:

€150,000 for each fiscal year in which computer systems that do not comply with the provisions of Article 29.2 of the LGT and its implementing regulations have been sold.

€1,000 for each computer system sold without the required certification.

€50,000 for each fiscal year in which a computer system has been used that does not comply with the provisions of the law, does not have the required certification, or if the certified devices have been altered or modified.

The Digital Kit offers financial support for the adoption and implementation of electronic invoicing systems. Some autonomous communities offer grants and other resources to complement it.

Certain Chambers of Commerce and other specialized business organizations offer free or subsidized training for companies, SMEs, and self-employed workers on electronic invoicing and tax regulations.

The digital headquarters of the Spanish Tax Agency (AEAT) provides taxpayers with guides, manuals, and supporting documentation to answer specific questions.

Save your invoices as drafts so you can check that all the information is correct before approving and sending them to the tax authorities.

Cancel your invoices if you need to. With Holded's automatic connection to the Tax Agency, they will still be registered.

Complies with anti-fraud legislation; any changes to billing will be recorded so that the information is accessible to the tax authorities.

Always constantly improving, ready for electronic invoicing, and complying with all public administration requirements.

Without installing anything, send your invoices directly to the tax authorities without leaving Holded and keep your invoicing connected to the rest of your business.

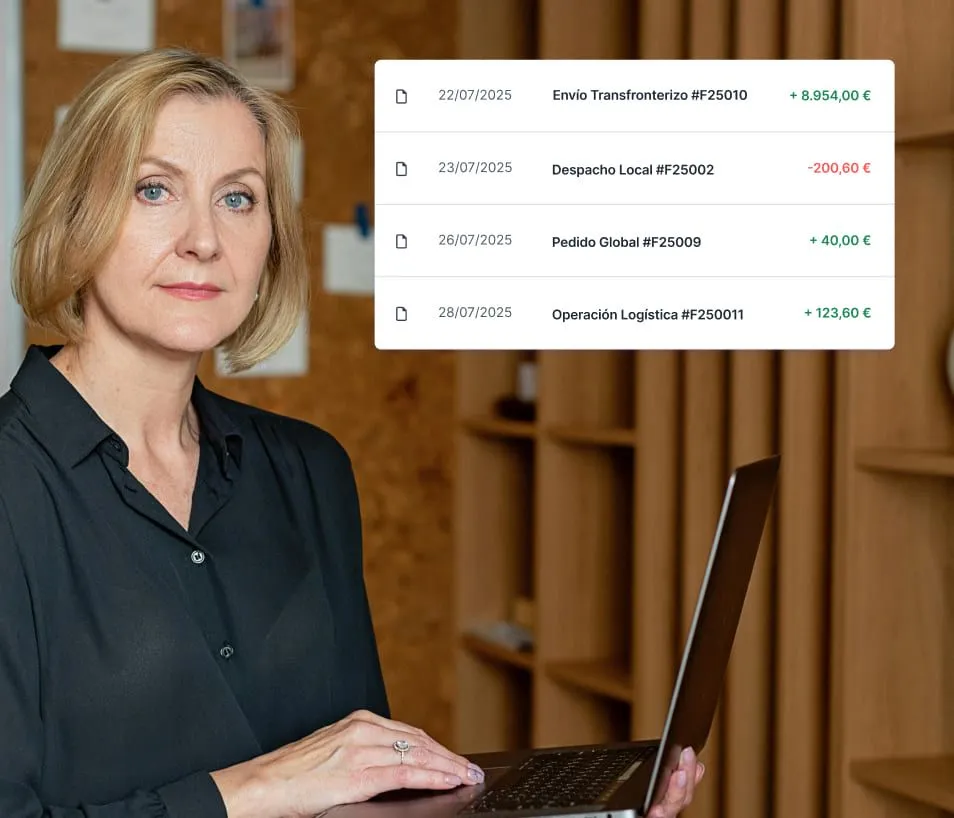

Whether you do your accounting internally or with an advisor, Holded gives you access to all your financial information in real time.

You can always talk to our team.

Everything you need to know about Holded with tutorials and videos.

Verifactu is an electronic invoice verification system promoted by the Tax Agency that aims to combat tax fraud and promote digitization in business accounting processes. An electronic invoice is a digital document that certifies a transaction. Every invoicing program, such as Holded, must integrate the Verifactu system in order to be certified by the AEAT.

Identifying an invoice issued with Verifactu is relatively easy, as they must meet the following characteristics: They include a QR code with identifying information. They include the reference “Verifactu,” which certifies that the invoice has been generated using a verifiable invoice issuance system. They are sent in XML format to the tax authorities online. These invoices allow the buyer to check them by scanning the QR code. There must be a record of each invoice and event as backup.

If the billing program does not comply with Verifactu regulations, a penalty in the form of a fine of up to €50,000 will be imposed for each fiscal year in which the illegal program has been used. The same applies if certified software is altered or modified.

No, once the invoice has been issued and sent through the Verifactu system, it cannot be edited or deleted. This guarantees its integrity and traceability. In case of error, a corrective invoice, a cancellation record, or a replacement invoice must be issued, as appropriate. Invoicing software, such as Holded, complies with these requirements, so it does not allow any direct modification of invoices already registered, but it does allow you to issue corrective invoices quickly and easily.

Verifactu is an invoice verification system, i.e., a platform designed to manage electronic invoices, guaranteeing their authenticity, traceability, and integrity, thanks to compliance with the requirements established by the Tax Agency. Invoicing software sends the data from each record to the AEAT. Each document has a hash code and a QR code that allow each invoice to be validated and its authenticity to be ensured. In addition, these codes are linked to each other, which allows the traceability of invoices to be checked and prevents them from being modified. These features help to improve transaction security, digitize and automate invoicing and accounting processes, and simplify tax management for freelancers and companies, reducing potential errors. The process includes issuing the invoice through validated invoicing software, automatically sending it to the Spanish Tax Agency (AEAT) (for the time being, this step will be voluntary), generating the hash and QR codes, and verifying the invoice in real time, a step that can be performed by both the issuer and the recipient.

Verifactu was created with four main objectives:

1. To combat tax fraud by ensuring the integrity and traceability of invoices.

2. To digitize the business fabric and tax processes.

3. To improve tax control by giving the tax authorities more direct control over commercial operations.

4. To increase transparency by offering customers the possibility of verifying the validity and accuracy of invoices.

The entry into force of Verifactu affects three key players in the invoicing process: the software used to issue digital invoices, large companies, and SMEs and self-employed workers. For the former, the obligation to adapt to the requirements of the regulation began on July 29, 2025. The next key date is January 1, 2027, when large companies, i.e., corporate tax payers with an annual turnover of more than eight million euros, must begin to use this type of software. Finally, all other companies and self-employed workers will have until July 1, 2027, to adapt to Verifactu.

Verifactu allows you to validate your invoices with the tax authorities automatically and 100% securely, using a background process that runs while you work, without the need for any additional steps. All you have to do is use compatible software to issue your invoices and select the Verifactu mode, so that they are sent to the tax authorities automatically and instantly. The program will generate a record with the invoice information and a unique code that will allow it to be identified unequivocally. In addition, all invoices will include a QR code that customers can use to verify that the invoice is correct and has been declared to the tax authorities. Each record contains a hash or digital fingerprint that identifies the events related to the invoice, ensuring that it has not been modified. Finally, all invoices generated with this system must include the Verifactu legend, indicating that they have been issued through this system.

Those most affected by the entry into force of Verifactu are companies and self-employed workers, who will be required to use software compatible with this system. However, they will be able to choose whether they wish to send their records to the tax authorities automatically and in real time. Verifactu does not apply in regional territories, which have their own systems—such as TicketBAI—nor does it affect companies required to provide immediate information (SII) or self-employed workers who pay taxes under special regimes, such as modules or equivalence surcharges. For their part, professional firms have taken on a more active role in advising and managing their clients, which has involved updating their tools, adapting processes, and training their staff to meet the new requirements.

To find out if your software complies with Verifactu regulations, you can consult your provider directly or request a signed statement from their legal representative certifying that the software complies with the requirements of the Anti-Fraud Law.

In addition, the Tax Agency has published an official list of software approved by the AEAT.

As mentioned above, all invoicing software must comply with the following functions:

1. Generation of QR codes on invoices.

2. Signing of invoices.

3. Event logging and traceability (activity history).

4. Generation of a hash or digital fingerprint for each invoice.

5. Guarantee of the inalterability of records.

If you use Holded, you don't have to worry about anything else: the software is fully compatible with regulatory requirements and is updated to adopt Verifactu as of this moment.